What Do Employers Want From College Grads This Year?

Reply

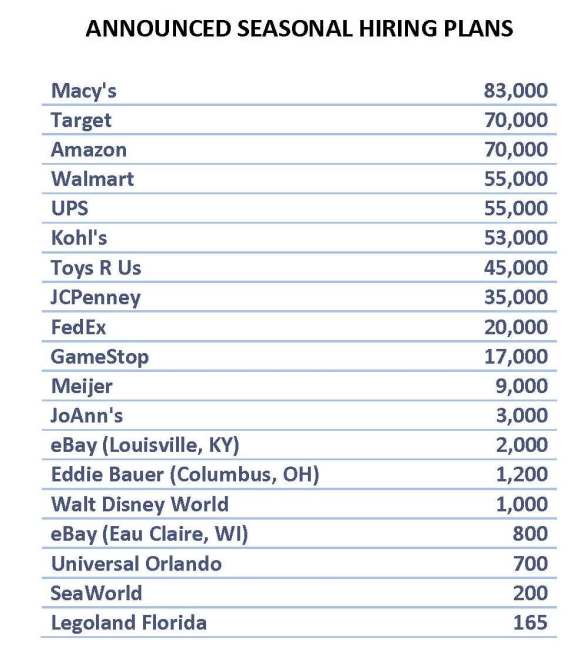

Check out who is hiring for the season. Let us know if there are others!

A new survey of human resources executives provides further evidence of just how difficult it is in a non-manufacturing-based economy to quickly increase employment following a downturn and why it could be another year or more for the unemployment rate to fall to pre-recession levels.

In the survey conducted by global outplacement consultancy Challenger, Gray & Christmas, Inc., just over half (53 percent) of the human resources executives polled said their companies implemented workforce reductions as a result of the recession that began in December 2007 and ended in June 2009. The good news is that 82 percent of companies have added new workers since January 2010. However, while 33 percent of those hiring were able to bring back some of their former workers, 67 percent indicated that the re-staffing process started from scratch.

Meanwhile, less than half (43 percent) of the companies adding new workers have reached or surpassed the number of workers employed prior to workforce reductions. Nearly 15 percent said they expect to eventually return to pre-layoff workforce levels. However, 43 percent indicated that their companies will meet future demand with fewer employees, suggesting that their payrolls will never return to pre-recession peaks.

“What we have come to know as ‘the jobless recovery’ may be the new post-recession norm, as employers rebuild their workforces from scratch, take more time to vet candidates, and find ways to operate with fewer workers,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

Monthly job cuts declined for the third consecutive month in May, as U.S.-based employers announced plans to trim payrolls by 36,398 during the month, 4.5 percent fewer than 38,121 cuts in April. The May total was 41 percent lower than the same month a year ago, when employers slashed payrolls by 61,887 , according to the report Thursday from global outplacement consultancy Challenger, Gray & Christmas, Inc.

To date, the nation’s employers have announced 219,560 planned job cuts in 2013. That is down 11 percent from the 245,540 planned cuts announced in the first five months of 2012.

It is not unusual to see job cuts decline during the summer months. In fact, May is historically the slowest job-cut month of the year, averaging 57,688 since 1993. The next lowest job-cut month is June, according to Challenger records, which show it averaging 59,887 since 1993. The overall average monthly total across all months since 1993 is 70,288.

The heaviest job-cutting last month occurred in the health care sector, where 4,886 job cuts were tracked. That was up slightly from 4,268 health care job cuts in April and more than double the 2,353 announced in May 2012. Overall, layoffs in health care are up 71 percent in 2013 to 20,867, compared to 12,177 in the first five months of 2012.

Only two other sectors have seen bigger gains: media, where job cuts have increased 249 percent from 1,829 in the first five months of 2012 to 6,388 as of May; and the financial sector, which has seen job cuts increase by 103 percent from 17,284 in 2012 to 35,091 this year.

Largest Job Cut Increases

|

Jan-May 2012 |

Jan-May 2013 |

% Change |

|

| Media |

1,829 |

6,388 |

249.3% |

| Financial |

17,284 |

35,091 |

103.0% |

| Health Care/Products |

12,177 |

20,867 |

71.4% |

| Retail |

20,983 |

32,683 |

55.8% |

| Non-Profit |

938 |

1,443 |

53.8% |

While prices at the gas pump are still higher than most drivers would like, more American workers are expected to use their vacation days this summer, thanks to the steadily improving economy, increased job security and reasonable airfares. Increased summer travel, beginning with the Memorial Day holiday, is likely to boost hiring across several travel-related sectors, including leisure and hospitality, food service, retail, and entertainment, according to the employment experts at global outplacement consultancy Challenger, Gray & Christmas, Inc.

“For young job seekers on break from high school or college, travel and leisure-related industries offer a wealth of employment opportunities. While many employers have already hired the bulk of their seasonal workers by this point, it is still not too late to find openings, particularly for those who live near or are willing to temporarily relocate to popular travel destinations,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas. Continue reading

More opportunities for teens this summer if they get off the computer and in front of employers.

Continued employment gains across the economy, but particularly in lower-skilled, lower-paying hourly wage categories, are expected to benefit teenagers seeking jobs this summer, according to a new outlook released Thursday by global outplacement consultancy Challenger, Gray & Christmas, Inc.

While job-seeking teens are likely to face competition from recent college graduates, as well as those at the opposite end of the age spectrum, employment gains for 16- to 19-year-olds in May, June and July should surpass last year’s levels.

“There will definitely be more opportunities for teenagers seeking employment this summer. Of course, it is still a competitive environment. So, teens should not expect employers to come knocking on their door. The search will require maximum effort, starting now, in order to have a position lined up before the school year ends,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

The nation’s employers reported job cuts totaling 49,255 in March, a decline of 11 percent from the 55,356 cuts announced in February, according to the latest report on downsizing activity released Thursday by global outplacement consultancy Challenger, Gray & Christmas, Inc. Despite the decline, quarterly job cuts reached their highest level since 2011.

March job cuts were 30 percent higher than a year ago, when employers announced plans to shed 37,880 workers from their payrolls. This marks the second consecutive month and the fourth time in the last six months that the job-cut total was higher than the year-ago figure.

Employers have now announced 145,041 job cuts through the first three months of 2013. That 5.6 percent higher than the previous quarter’s 137,361 job cuts and 1.4 percent higher than the 143,094 job cuts announced in the first quarter of 2012. The first-quarter total is, in fact, the highest quarterly tally since 233,258 job cuts were tracked in the third quarter of 2011.

With college seniors around the nation returning to their respective campuses following spring break recess, many will undoubtedly turn their attention to their impending graduation and the search for their first post-collegiate job. A new analysis of the entry-level job market estimates that while the job market continues to strengthen for college graduates, the environment remains highly competitive, which may force some to pursue unexpected career paths.

In its annual college graduate job-market outlook, global outplacement consultancy Challenger, Gray & Christmas, Inc. says this year’s crop of 1.8 million bachelor’s degree recipients will be able to take advantage of the 36 consecutive months of private-sector employment growth that has occurred since the jobs recovery began in earnest in March 2010.

“Job creation has been slow, but it has been steady. Over the past 14 months, private payrolls have grown by an average of 190,000 new workers per month. There are a growing number of opportunities for job seekers, but the search definitely requires an aggressive approach. This is especially true for new graduates, who are likely to have less real-world experience to point to in job interviews,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

“This lack of experience would have less impact if they were only competing for jobs with their fellow graduates. However, in this economy, it is likely that they will be vying for entry-level job opportunities with those who have been in the workforce for one to five years. They may even be competing with seniors looking for any opportunity to continue working even it means taking a dramatic cut in pay, title and responsibility,” he added.

Despite increased competition for entry-level positions, the latest data on starting salaries suggest that demand for new graduates is on the rise. According to a January survey by the National Association of Colleges and Employers (www.naceweb.org), the average starting salary for new college graduates earning bachelor’s degrees increased 3.4 percent over last year. The biggest gains were achieved by those in education, whose starting salaries rose by 5.4 percent from $38,581 for the class of 2011 to $40,668 for last year’s graduating class.

While those in education saw the biggest increase, last year’s graduates with a bachelor’s degree in engineering enjoyed the highest starting salary at $62,655, up 3.8 percent from $60,344 for 2011 graduates.

Engineering and technology graduates are likely to experience some of the shortest post-graduation job search times. In fact, the most talented students in these fields may have multiple job offers to weigh before they even collect their diplomas, according to Challenger.

Retirement Worries May Create Workforce Gridlock

A new survey this week showing that older Americans are more pessimistic than ever when it comes to their ability to afford retirement could be a sign that an increasing portion of the workforce will opt to continue working beyond the traditional retirement age. While continued employment will help aging Americans avoid financial hardship, it could make it increasingly difficult for younger workers to climb the employment ladder. In the widely reported survey conducted by the Employee Benefits Research Institute, nearly half of all American workers and retirees were either “not too confident” or “not at all confident” about being able to afford a comfortable retirement. There is good cause for concern for many older workers, according to the survey, which found that 52 percent of those 55 and older have less than $50,000 in retirement savings. Despite the concern and the lack of savings, only 23 percent of survey respondents have sought professional financial advice to help them plan for retirement. These trends create a lot of problems in the workforce, according to employment authority John A. Challenger, chief executive officer of global outplacement and executive coaching consultancy Challenger, Gray & Christmas, Inc. “These older workers will want to…make that, need to stay in their jobs longer. And employers may oblige, since they value the experience and increased productivity these workers bring to the table. Employers may even be able to negotiate lower salaries for the prospect of increased job security. This is great for the experienced workers trying to delay retirement, but it significantly diminishes advancement opportunities for younger workers. Of course, this could backfire for employers when these older workers finally retire and they are faced with a wide experience gap between those leaving and those who remain.” What are the pros and cons of older workers staying on the job beyond the traditional retirement age? What can companies do to ensure that younger workers have opportunities to advance within their organizations? What other employment/second career opportunities exist for experienced workers who do not want to stay in their current job or want to re-enter the workforce? Continue reading

Planned job cuts increased for the second consecutive month in February as U.S.-based employers announced workforce reductions totaling 55,356, up 37 percent from 40,430 in January, according to the report released Thursday by global outplacement consultancy Challenger, Gray & Christmas, Inc.

The February total was 7.0 percent higher than the 51,728 job cuts announced the same month a year ago. It was the highest monthly tally since last November, when announced layoffs reached 57,081.

Employers have now announced 95,786 job cuts so far in 2013. That is 9.0 percent fewer than the 105,214 job cuts through the first two months of 2012.

The financial sector dominated job cuts last month, with firms announcing 21,724 planned layoffs, the most since 31,167 were announced in September 2011. Last month’s total was nearly three times more than the 7,611 job cuts announced by financial institutions in January. Employers in this sector have now announced 30,302 job cuts this year, which is nearly 75 percent of the 41,008 financial job cuts announced in all of 2012.